At the end of December 2024, the aggregate value of total transactions carried out through UPI in India had risen to ₹23,00,000 Crores, approximately commensurate with 16,730.01 million transactions. Furthermore, in the year 2024, the transactions under the aegis of the Government of India will amount to around ₹164.4 billion, and with such large-scale online transactions, it becomes imperative to enforce strong security measures such as a Digital Signature Certificate (DSC). For securing online transactions, getting one’s own DSC for PayManager Digital Signature is an easy way initiated by the Union Government of India for all states; however, it is mandatory in Rajasthan.

Rajasthan government employees using the pay manager system for salary slips and financial information is necessary. Hence, a DSC for Pay Manager is needed here. It acts as a digital fingerprint to Paymaanger so that the identity is authenticated, and the online transaction remains safe and secure. Both employees and administrators pay managers to simplify payroll management. Employees utilize the platform to view pay stubs, request leaves, and submit timesheets. Simultaneously, the administrator can use the PayManager Digital Signature to approve payroll, generate reports, and maintain employee records.

What is PayManager Digital Signature?

The PayManager Digital Signature is an electronic signature in a payroll management system, like the ‘Pay Manager, ‘ that serves as a valid electronic document for any payment to the employee. The signature ensures that no one except authorized personnel can access or modify sensitive financial data. It acts similarly to a secure electronic stamp that confirms the authenticity of online transactions.

Key Features of PayManager Digital Signature

| Feature | Description |

|---|---|

| Security | Encryption prevents unauthorized modification of payroll data and ensures transaction integrity. |

| Authentication | Identifies who has made the payment or accessed the payroll data. |

| Legal Validity | Holds the same legal validity as a physical signature for online transactions. |

| Compliance | Required by law in most places for the secure management of tax payroll systems. |

Who can use a PayManager Digital Signature?

PayManager Digital Signature is authorized by government officials within the payroll system like Pay Manager, including Drawing and Disbursement Officers (DDOs), Circle Medical and Health Officers (CMHOs), Block Development Officers (BDOs), and other head departments responsible for approving and managing employees salaries and payments, only verified individuals can access and modify sensitivity financial data within the system.

| Officer | Responsibilities |

|---|---|

| Drawing and Disbursing Officers (DDO) | Manage financial transactions in government departments. |

| Block Education Officers (BEEO) | Authorize payments for teachers, staff, and school-related expenses. |

| Block Development Officers (BDO) | Sanction payments for local development projects like construction and services. |

| Circle Medical and Health Officers (CMHO) | Approve staff salaries, medical service payments, and health supply expenditures. |

How do I get an Individual DSC(digital signature certificate) for PayManager?

| Requirement | Details |

|---|---|

| Valid Identity Proof | Aadhaar Card, Passport, PAN Card, Driving License, or any other Government-issued photo ID. |

| Proof of Address | Utility bill (recent), Voter ID card, or Bank statement with subscriber’s photo. |

| Photograph | Recent passport-sized photograph. |

| Application Form | Complete the application form for any Certifying Authority (CA) of your choice. |

| Digital Signature Device | USB token or any device used to secure the user’s private key. |

| Fees | Pay the applicable fees to the Certifying Authority (CA). |

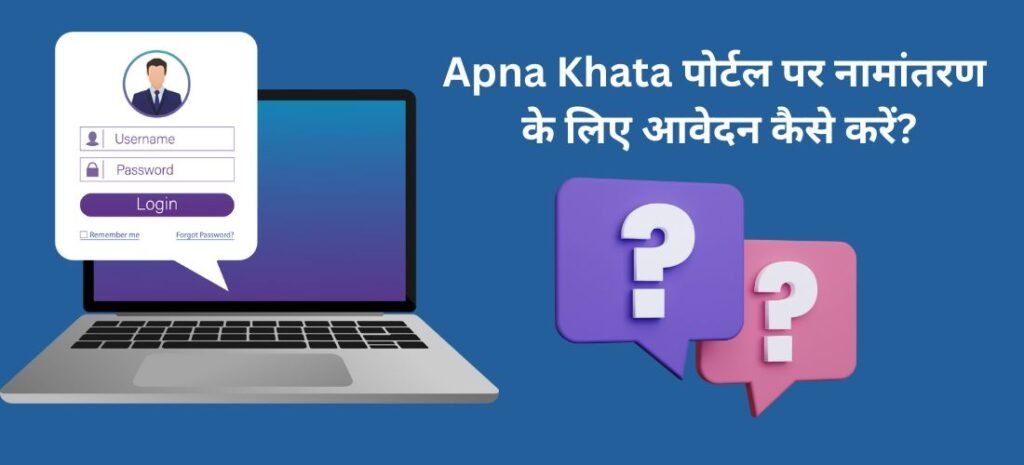

How do I Login on PayManager Online?

To log in to PayManager you can follow these simple steps:

- Step 1:- Open the web browser and go to the official PayManager website(https://paymanager.rajasthan.gov.in/).

- Step 2:- Click on the section labeled “DDO Login“

- Step 3:- Add username and password

- Step 4:- Enter the CAPTCHA for additional verification

- Step 5:– Click on the login button after entering your details

- Step 6:- After logging in, you will be directed to the Paymanager DDO dashboard, where you can manage your payroll tasks, handle financial activities, and submit bills.

Also Read: ई मित्र रजिस्ट्रेशन लॉगिन राजस्थान | पहचान पोर्टल राजस्थान के लाभ एवं विशेषताएं

How to download the Salary Slip From PayManager?

- Log in to the official website.

- Type the username and password on the login page.

- Check the employee option, enter the captcha, and click on the button to proceed.

- Go to the profile and select the option “Employee Report.”

- Click on “Pay Slip” to obtain the Salary Slip.

- Choose a month and year to submit.

- The salary slip will appear on the computer screen.

- Next, click the download icon and save it for later.

How to check your salary bill status on PayManager?

- Type your employee ID and password in the PayManager login.

- Type the OTP sent to your mobile number and submit it.

- Go to TA Medical Bills and select “Bill Wise Status.”

- Select the month, year, and bill type.

- The status of your bill will appear on the screen.

Also Read: Apna Khata Rajasthan में जमाबंदी नक़ल कैसे देखें? | भूलेख राजस्थान जमाबंदी नकल ऑनलाइन देखें

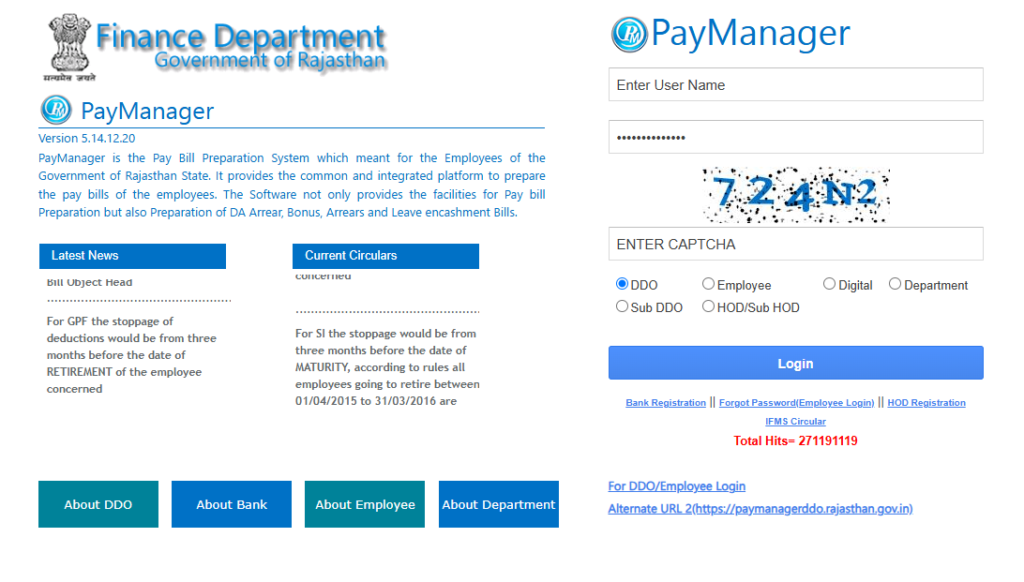

What To Do If You Forget Your PayManager Employee ID?

- Open PayManager Website(https://paymanager.rajasthan.gov.in/) on your browser.

- Now find and click the link that says “Forgot Password Employee ID”.

- Hence, you should now provide your employee ID, bank account number, DOB, and mobile number as requested.

- You shall receive either a reset link or a code for resetting your password; follow the instructions to complete the process.

- Now you will be able to log in to the PayManager Employee ID.

How do I renew my Individual DSC(digital signature certificate) for PayManager?

Steps to Renew an Individual Digital Signature Certificate (DSC) for PayManager :-

| Step | Description |

|---|---|

| Step 1 | Log in to the renewal site of a Certifying Authority(Like: https://www.mca.gov.in/MinistryV2/updatedsc.html) |

| Step 2 | Enter existing DSC details and select the DSC renewal option. |

| Step 3 | Submit relevant documents for background verification. |

| Step 4 | Pay the renewal fee and download the renewed DSC to a USB device. |

Note:- If you want to be aware of it You need to do this fairly before the expiration of your existing DSC

Also Read: How to verify an E-stamp on the MPIGR website (MPIGRS)?

Benefits of using Individual DSC for PayManager

| Benefit | Description |

|---|---|

| Enhanced Security | DSCs ensure only authorized users can access or modify data, preventing unauthorized entry and tampering. |

| Authentication & Authorization | Verifies user identity to ensure only qualified personnel can execute specific tasks like signing pay bills. |

| Government Regulations Compliance | Mandatory in Rajasthan for secure online transactions, ensuring compliance with official requirements. |

| Enhanced Efficiency | Eliminates manual procedures and physical signatures, making payroll processing faster and more efficient. |

Also Read: अपना खाता Jamabandi Rajasthan के लाभ | techo.gujarat.gov.in login

Digital Signature for PayManager Use Cases

In a Pay Manager System, a digital signature is used to securely authenticate and verify the identity of individuals who approve payroll transactions and financial documents. This ensures data integrity and prevents tampering with sensitive financial information, expenses approvals, and payroll adjustments, and effectively serves as a legally binding electronic signature for critical processes such as salary disbursements. Additionally, it streamlines workflows and eliminates the need for physical paperwork.

1. Employee Salary Contracts

When a new employee begins work, the employer presents them with a document that describes their salary, benefits, and other key information. Rather than signing this document in person, they can use an electronic certificate to indicate that they accept the terms.

2. Expense Reimbursement Approval

A Paymanager digital signature can be applied when the employee paid work expenses such as travel or supplies and requires reimbursement from the company. The manager can approve and review the expenses electronically without having to sign any forms. It’s quicker and more convenient to receive the money back.

3. Payroll Processing

A digital signature certificate DSC in the pay manager can be used to verify payroll documents like pay stubs, tax reports, and direct deposit authorizations. This ensures that only the appropriate individuals have access to and approve sensitive payroll information.

4. Vendor Payments

If your business has to make payments to other companies for goods or services, DSC signatures can be utilized to authenticate that such payments are approved. It ensures the approval process and indicates that the payment is authentic, minimizing the chances of fraud or unauthorized payments.

5. Contractor Agreements

When an organization employs a person to perform a particular task for a certain period, there is a contract. A Paymanager digital signature can be utilized to sign such contracts electronically, making the recruitment process more efficient and easier. It’s shaking hands for cooperation but in the virtual world.

6. Employee Onboarding

When new employees are hired, there is a lot of paperwork to be filled out, such as tax and benefits forms. Rather than printing and signing these forms, DSC certificates enable new employees to sign all of this electronically even before they enter the office.

7. Compliance Documentation

Businesses must adhere to regulations and guidelines from the government and other bodies. Paymanager digital signatures assist in confirming that the business is adhering to these regulations through secure signing and storage of vital documents. It’s similar to a digital stamp of approval indicating that all actions taken are legally binding and enforceable.

Conclusion

Integrating a digital signature feature into the PayManager system greatly improves security and efficiency. It offers a verifiable and tamper-proof method for electronically signing payroll documents and ensures the authenticity of financial transactions. It offers a verifiable and tamper-proof method for electronically signing payroll documents, ensuring the authenticity of financial transactions. This enhancement streamlines the approval process, ultimately reducing administrative overhead and improving data integrity within the payroll management system.

FAQs

Q1. What is a digital signature in an e-payment system?

A digital signature is a cryptographic method to guarantee the authenticity and integrity of a digital document, message, or data. It offers a mechanism to guarantee that the sender of the information is authentic and that the information’s content has not been altered in transit.

Q2. What is the application of digital signatures?

A digital signature is an electronic seal that confirms the validity of digital data. It’s employed to protect documents, messages, and transactions.

Q3. What is the problem solved by a digital signature?

A digital signature is designed to address the issue of tampering and impersonation in electronic communications. Digital signatures can serve as evidence of the origin, identity, and status of electronic documents, transactions, and digital messages. Signers can also utilize them to confirm informed consent.

Q4. What is a DSC Alert in Income Tax?

DSC verifies an electronic document in the same way a handwritten signature verifies a printed/handwritten document. DSC can be utilized to e-verify the returns submitted by the taxpayer, and in certain situations, it is also required.