PM SVANidhi Scheme refers to a government initiative to provide financial assistance across India- especially street vendors- for those affected due to COVID-19. Launched on 1st June 2020, to provide loans up to ₹ 50,000 with affordable interest along with benefits like collateral-free loans. With this loan, the interest charged is 7% per annum and repayment period is 1 year. All this combines financial inclusion, and digital payments, empowering to contribute to the economy for a risk-free financial future.

In this blog, we discuss how the PM SVANidhi Scheme works, who is eligible, and how to apply for a loan under the scheme.

PM SVANidhi Scheme: Overview

PM SVANidhi Scheme is an initiative launched by the Ministry of Housing and Urban Affairs in 2020 as part of the Atmanirbhar Bharat initiative. The goal of the scheme is to extend micro-financing solutions for street vendors who need finances to revive their businesses to scale up. Giving easy access to credit to vendors who would otherwise find hard to obtain loans due to the absence of a formal credit history or collateral.

| Scheme Name | PM SVANidhi |

| Launched In | 1st June 2020 |

| Max. Loan Provided | Up to 50,000 Rs. |

| Interest Per Annum | 7% |

| Repayment Period | 1 year |

Also Read: apna khata | bhu naksha | bhulekh rajasthan

Features of the PM SVANidhi Scheme

1) Loan amount

PM SVANidhi extends loans to a maximum amount upto ₹50,000. That is provided as working capital where one will be able to support operational costs day by day. This includes buying supplies or enhancing street vendors’ business infrastructure.

2) Repayment period

The repayments are to be within 12 months, making it easy for vendors not to suffer from financial stress in repayments.

3) Interest Subsidy

All vendors, provided they repay the loan within time, can avail of a 7% interest subsidy. The overall cost of borrowing is reduced and becomes manageable for the street vendor.

4) Collateral-Free Loans

One of the best advantages of PM SVANidhi loan without collateral. Lenders don’t have to pledge any assets to avail of the loan.

5) Access to Additional Loans

Once the lender repays the first loan successfully, a lender may become eligible for a further additional loan of up to ₹20,000. These are expected to motivate vendors to expand their businesses further.

6) No Credit History

A credit history is not necessary for those street vendors who have no formal credit history. Thus, this loan will be obtained by the majority of street vendors who might have difficulty in raising funds.

7) Online as well as Offline Application

Vendors can apply online or offline because the procedure is flexible.

Also Read: techo.gujarat.gov.in login | jamabandi rajasthan | mpigr home

Eligibility for the PM SVANidhi Scheme

The eligibility criteria for the PM SVANidhi Scheme have different parameters, to avail the benefits beneficiaries fall in eligibility criteria.

1) Street Vendors

Only those vendors who vend food, goods, or services on the streets. These include vegetable vendors, fruit sellers, snack vendors, tea stalls, small shop owners, etc.

2) Present Street Vendors

The scheme is for the existing vendors who have been running their business at the same location or have an ongoing trade. New vendors who begin their business after the launch of the scheme not included.

3) Street Vendors in Urban Areas

The scheme is applicable only to those vendors who are working in urban areas (cities, towns, etc.).

4) Documentation

Applicants should have valid identification proof, address proof, and bank account details. Vendors with informal documents such as PAN & Aadhaar cards permitted to apply.

Also Read: खाता खसरा नकल | बी 1 खसरा ऑनलाइन cg | नरेगा जॉब कार्ड लिस्ट राजस्थान

How to Apply for PM SVANidhi Scheme?

The application method for the PM SVANidhi scheme is simple and can be done online or offline. Here’s how one can apply:

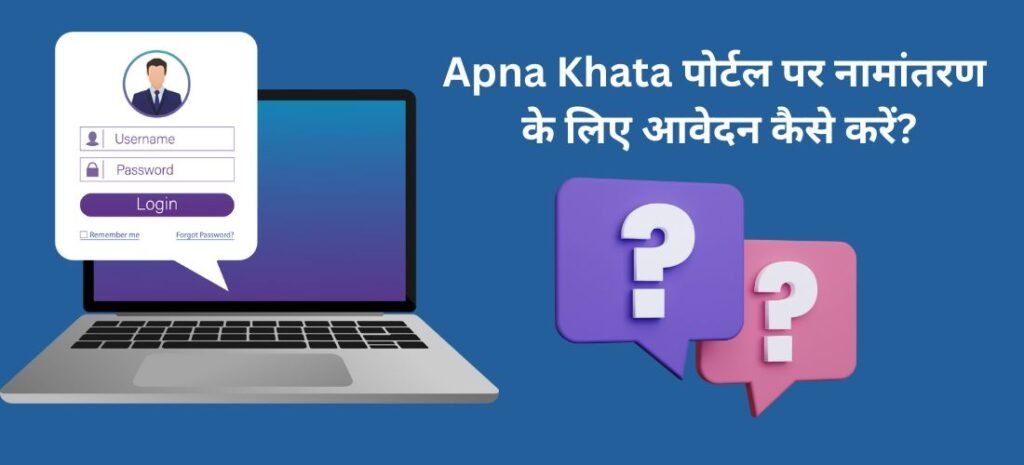

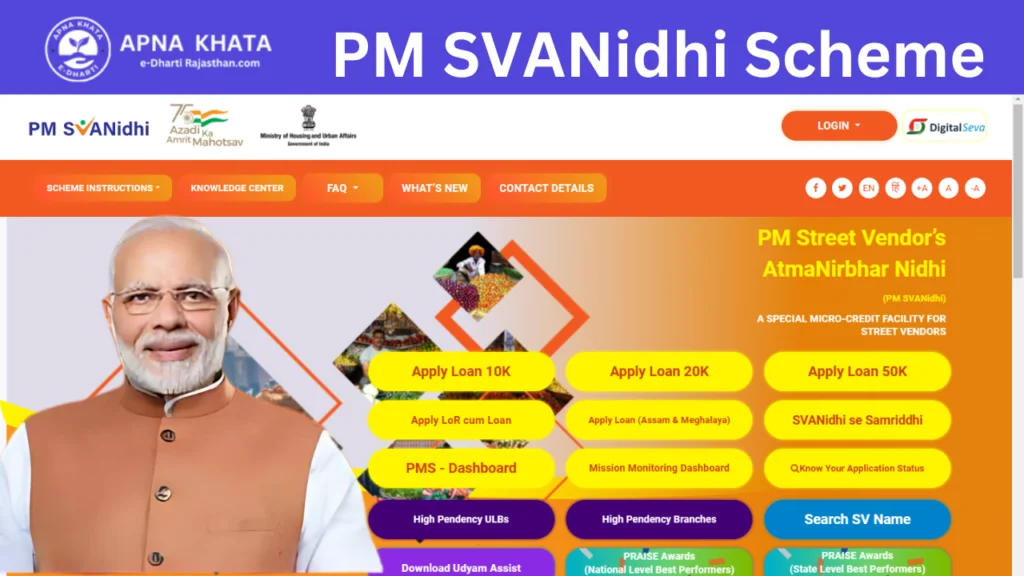

PM SVANidhi Loan Apply Online

- Step 1: Go to the PM SVANidhi Portal https://pmsvanidhi.mohua.gov.in/ and click on the Applicant in “Log In” button on the homepage.

- Step 2: Enter mobile number and the captcha code, then click on “Request OTP.”

- Step 3: Proceed to choose the right “vendor category” in the list, and then provide the required “Survey Reference Number” (SRN).

- Step 4: After filling in all these details, finally submit the online application form along with the necessary documents.

Disclaimer

- For any type of clarification and to access stepwise process details, refer User Manual.

- One can call on the toll-free number 1800111979 between 9.30 AM to 6.00 PM on Monday to Saturday except on national holidays, for any issue.

Apply Offline

- Visit the nearest CSC/ Municipal Corporation Office.

- Get all the needed details before proceeding with the application.

- Mobile No be linked to Aadhaar and is mandatory for the e-KYC / Aadhaar verification purposes

- When mobile number is registered with the same Aadhaar, it can help get the LoR from ULB if asked and obtain future Govt. schemes’ benefits too.

- Check on the status of the eligibility to apply on the applicable scheme’s guidelines.

- You will fall into one of four categories for street vendors.

- Review the eligibility and document/information required before opening an application.

Document Required

For 1st Loan

For Category A and B vendors :

- Certificate of Vending

- Identity Card

For Category C and D vendors :

- Letter of Recommendation

For Second Loan

- Loan Closure Document

KYC documents required in addition to CoV/ID/LoR :

- Aadhaar Card

- Voter Identity Card

- Driving License

- MNREGA Card

- PAN Card

For Letter of Recommendation:

- Copy of Account Statement/Passbook

- Copy of Membership Card/ Proof of membership

- Any other document to verify the claim as a vendor

- Request letter to ULB

Loan Categories Under the PM SVANidhi Scheme: Amount and Repayment Structure

1. PM SVANidhi ₹10,000 Loan(First Loan)

- This is an initial loan amount provided to eligible street vendors under the scheme. The loan is offered to such vendors to help them restage or continue their trade.

- Repayment period: 1 year

- The loan will be payable in monthly emoluments.

2. PM SVANidhi ₹20,000 Loan(Second Loan)

- The vendor avail of a second loan of ₹20,000 in case he repays the first loan on time.

- This loan is for those vendors who are planning to expand their business after getting the first loan.

- Repayment tenure: 1 year

3. PM SVANidhi ₹50,000 Loan(Third Loan)

- Those vendors who are able to pay the second loan on time apply for a higher amount of ₹50,000.

- This loan facilitates vendors to upgrade their business, enhance their infrastructure, and expand their market.

- Repayment period: 1 year

Advantages of PM SVANidhi Scheme for Street Vendors

- Financial Inclusion: The program provides financial inclusion to thousands of street vendors who, before this, were denied access to formal credit. Using the loan, the vendor better run the business and improve its operations.

- Boost to Business: The loan can be used by the vendors to purchase better-quality goods, enhance their business infrastructure, or scale up their business to reach beneficiaries.

- Ease of Access: The applicaiton process is clear and not complicated by elaborate paperwork or formal credit history even the smallest of vendors can apply.

- No Collateral: No collateral is required, hence a street vendor does not bear such risks of financial since a street vendor may not have assets to pledge.

- Support Recovery: Street vendors after the pandemic experienced a significant fall in income. PM SVANidhi Scheme offers them the much-needed capital to resume their business.

- Timely Repayment Incentives: The interest subsidy on timely repayments incentivizes the vendors to remain regular with their loan repayments and not default, thereby keeping their credit record good.

FAQs About PM SVANidhi Scheme

How much loan can I get under the PM SVANidhi Scheme?

Ans. A loan limit is up to ₹50,000 available for eligible street vendors.

Is any kind of collateral required?

Ans. A loan limit is up to ₹50,000 available for eligible street vendors.

How long is the repayment period?

Ans. The loan repayment period is 1 year, with flexible repayment options according to the vendor’s capacity.

Do I need a formal credit history for consideration?

Ans. No, formal credit history is not necessary. The application process is easy and accessible even for smaller vendors without a credit history.

What documents are required for the application?

Ans. The key documents used include an Aadhaar card, a copy of a bank account, a mobile number linked to an Aadhaar, a Survey Reference Number (SRN), business proof, and a photograph in passport size.

Also Read: Rajasthan Berojgari Bhatta Yojana | Bhavantar Bhugtan Yojana